BKK Pfalz recognized its policyholders’ wishes for digital care and advice options at an early stage. It is the first company health insurance fund to digitize the extensive consultation process for applying for long-term care benefits from long-term care insurance and to cover it completely with the help of an interactive consultation assistant. And this progressive approach is very well received by many members, with the digital advice assistant expertly guiding them through the application jungle and clarifying important questions. With a customized interactive video consultation, applicants are now individually guided through the entire application process.

The advantages are clear, as Andreas Lenz summarizes: “NEXOVI has no fixed consultation hours or even waiting times. It is available to our policyholders and interested parties 24 hours a day, seven days a week. We are also streamlining our application processes and ensuring a largely error-free procedure.” As the advice assistant is designed as a cloud application, it doesn’t matter from where and via which device a policyholder wants to use it – the range of applications offers the greatest possible flexibility. It has also paid off the design of the consulting assistant.

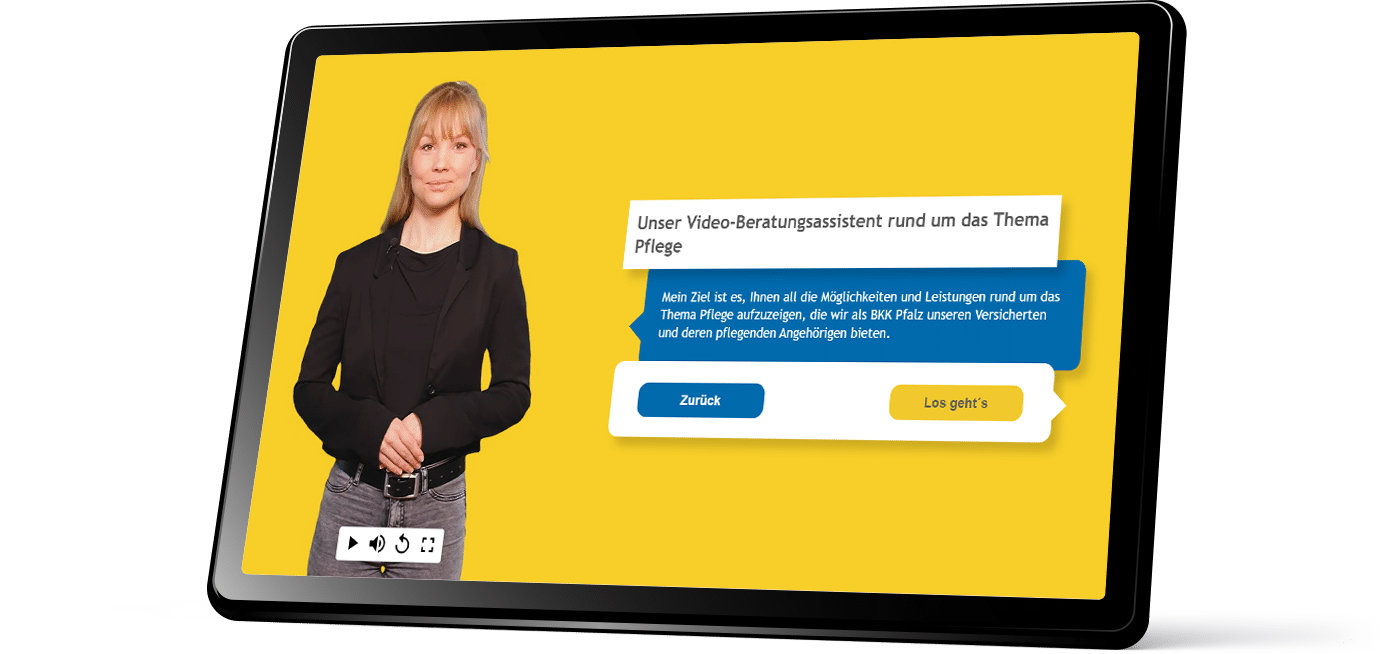

“We made a conscious decision to use real people as advisors who personally accompany an applicant,” explains Andreas Lenz. “This makes our solution very different from a chatbot, because people are there to help other people with advice and valuable tips.” The result: Applicants feel that they are in good hands and find answers to their questions with the advisory assistant, even in very complex procedures. BKK Pfalz benefits from a lean, modern service that reduces errors in advance, minimizes time-consuming reworking of applications and thus reduces service costs.